Approach To Building Clients’ Wealth

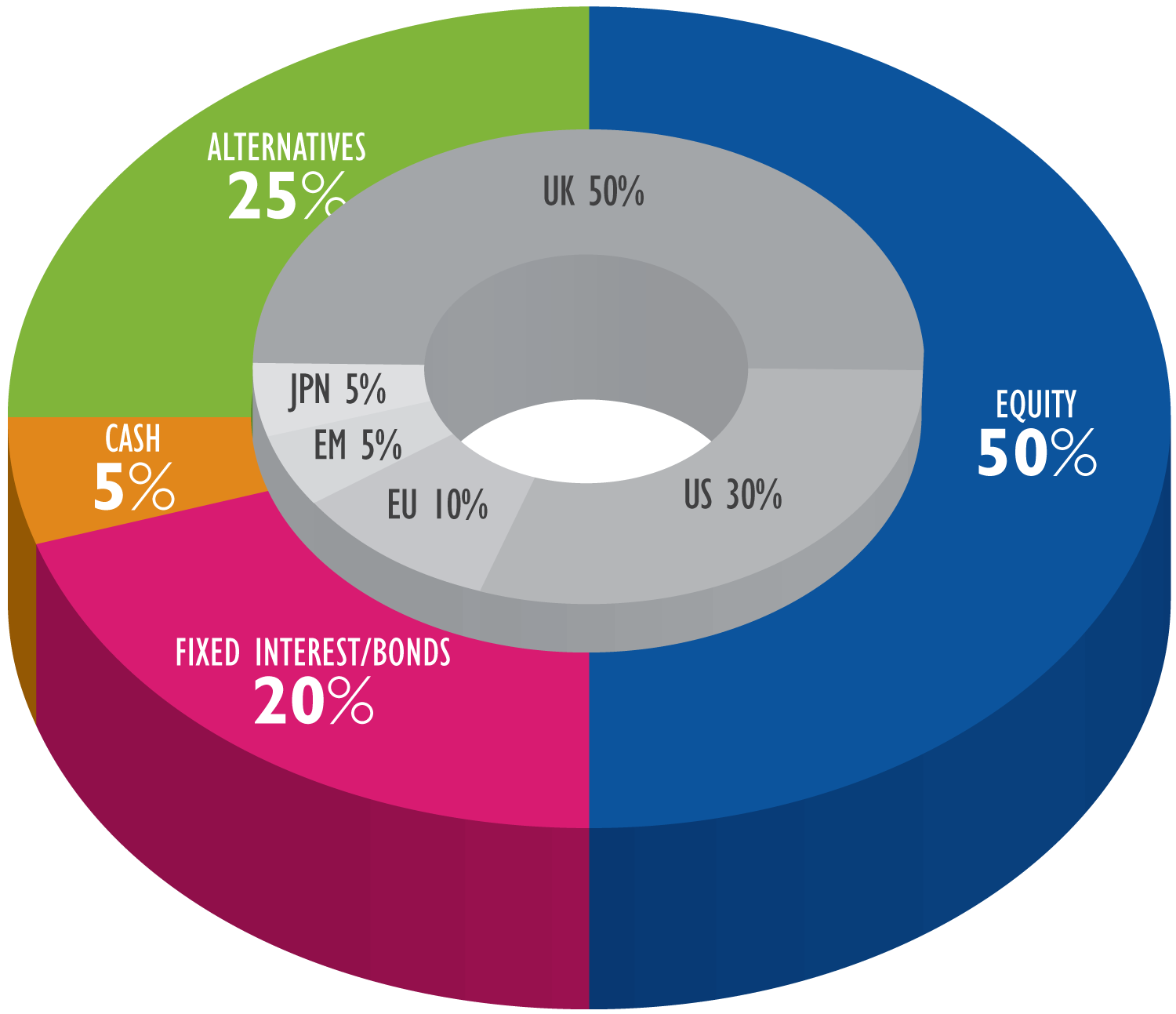

Founded upon a decade-long experience in the discretionary investment management space, TAM’s investment process centres on the following key principles.Providing clients with a range of well-balanced portfolios to fit different needs.

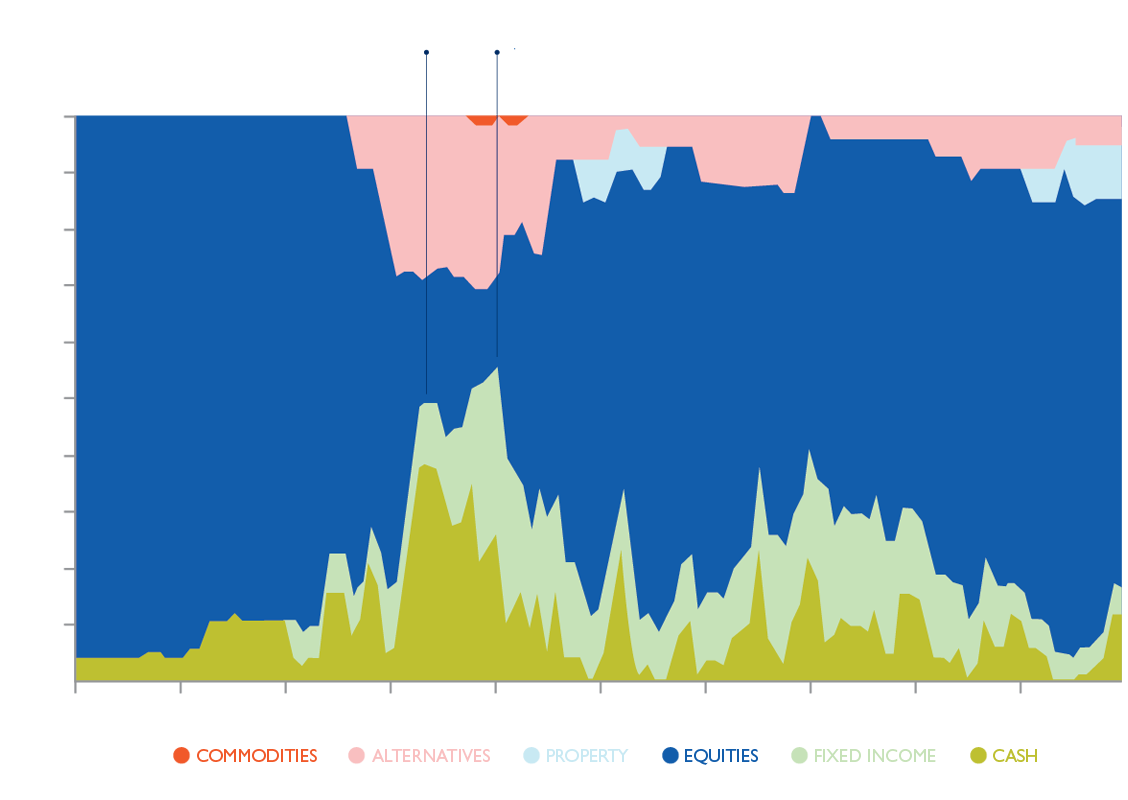

Ensuring all portfolios are adequately diversified to target ‘the smoothest ride’ possible.

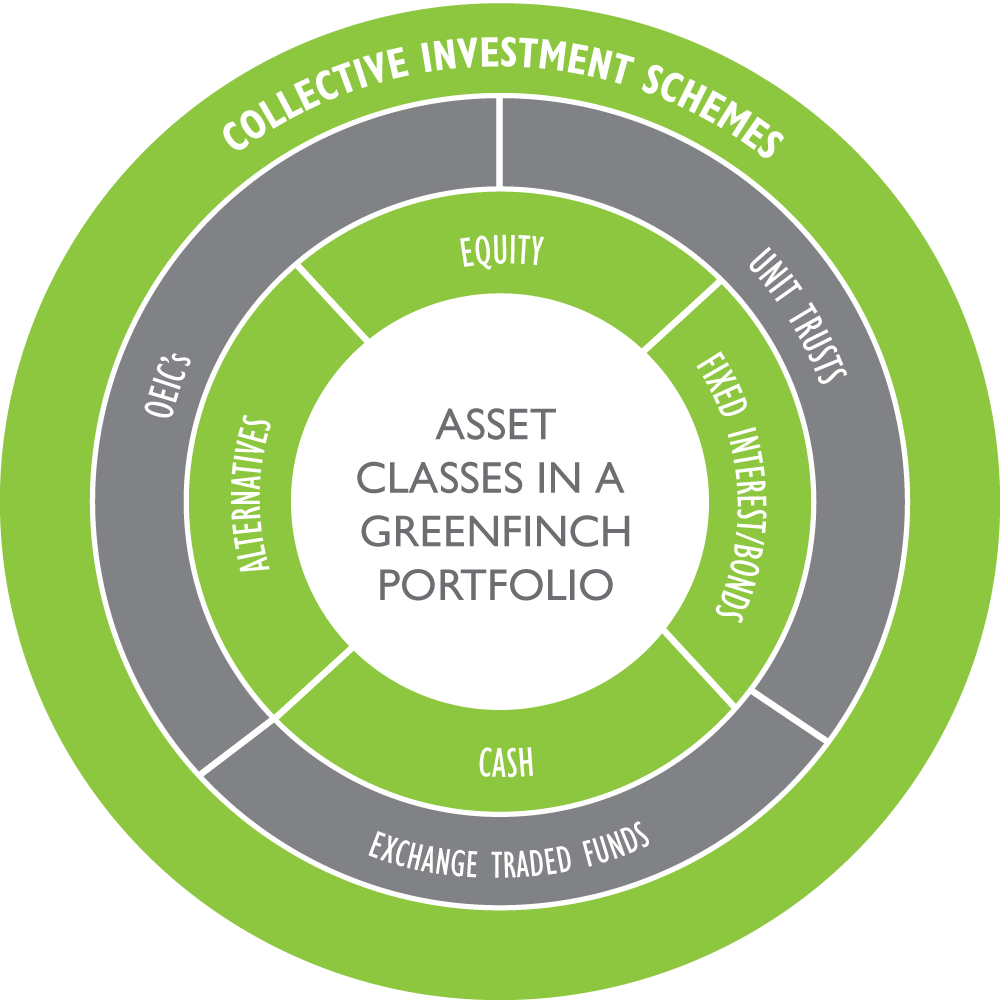

Proactively selecting and blending funds from some of the best investment talent in the world to build diversified portfolios in the pursuit of building clients wealth.